Services

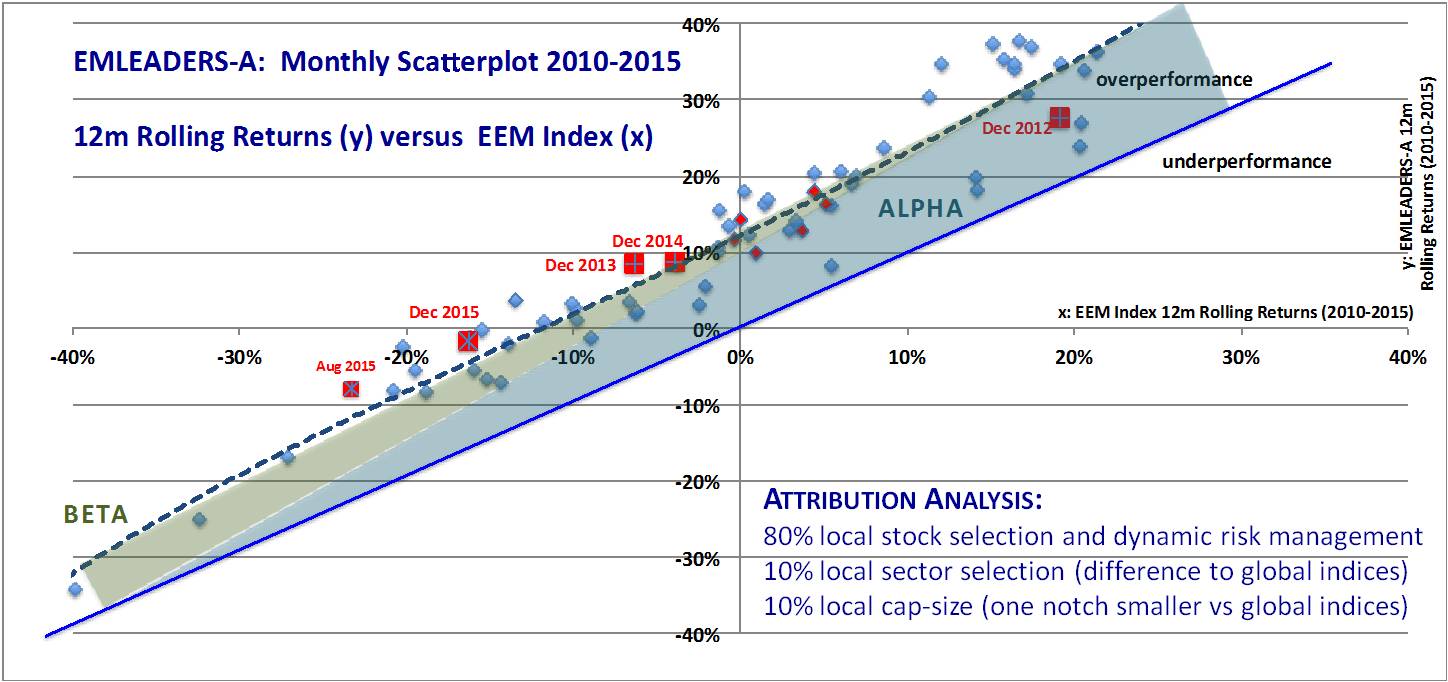

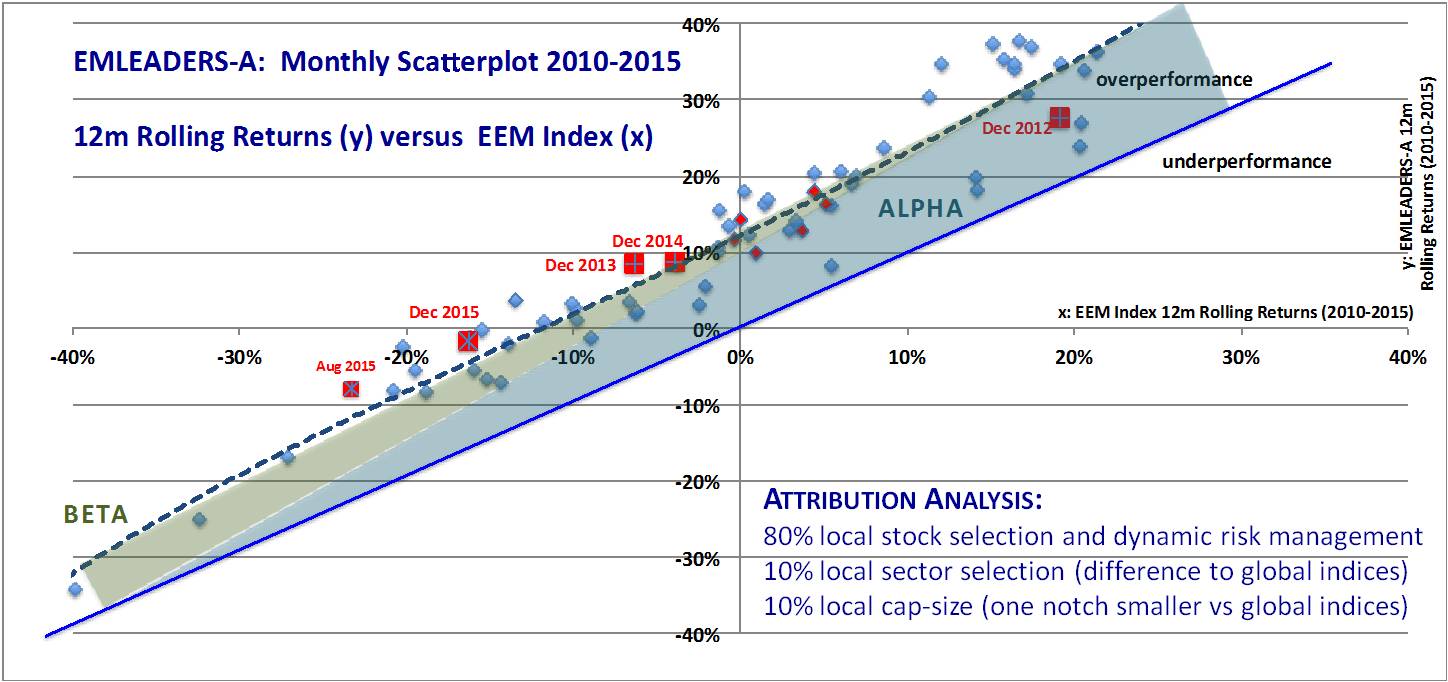

EM Leaders has established a multi-manager platform with leading local managers across emerging markets. EMLEADERS-A is a multi-manager portfolio of emerging markets equities composed of 20 leading local managers across 16 countries, covering 95% of the MSCI EM universe with similar country weights, i.e. 65% Asia, 20% EMA and 15% LATAM. The portfolio has been backtested for six years with the same set of 20 local managers, showing total US$ returns net of local manager fees. As benchmark, EEM is a major EM ETFs used as a liquid benchmark for the MSCI-EM universe.

As comparison, TOP GLOBAL EM FUND is shown as comparator among top-quartile US-listed mutual funds for emerging markets.

Note: past performance is illustrative only and cannot guarantee future results.

Below, performance has been illustrated for 12-months rolling returns plotted against the EEM benchmark returns. For example, in December 2015, EMLEADERS-A had 12-months-returns of -1% as compared to an EEM benchmark return of -16%, hence plotting an overperformance above the 45-degree-line. Attribution analysis reveals that about 80% of outperformance has been generated from bottom-up stock selection and dynamic risk management. In addition, 10% has been due to local sector selection and 10% has been due to one-notch smaller cap-size as compared to weights in the global EM indices. Please note that past performance and backtesting are illustrative only and cannot guarantee future results.